It’s a problem we’ve seen again and again: a once-flourishing healthcare business that’s slowly sinking into the red because they just can’t seem to keep a handle on their accounts receivable. This problem is only compounded by the fact that recent changes in healthcare and insurance law have created added pressure on various members of the industry. Between clients and insurance companies working with Net 30 arrangements to government agencies like Medicare and Medicaid dragging the payment cycle out even longer, it’s no wonder that many healthcare businesses are entering a period of financial distress.

Over the past Commercial Finance Group has built its reputation on helping businesses such as these. Healthcare companies, manufacturers, and even retail businesses who are being stymied by a lack of working capital for one reason or another, come to us because they’ve been told they’re “unbankable” and they’re looking for anything that will help them keep their doors open.

Commercial Finance Group provides custom lending solutions for companies all over the country. Instead of trying to squeeze all kinds of companies into the same lending mold, or forcing them into solutions that will only increase their long-term debt, we provide receivables financing and other financial products that allow them to turn negatives into positives, and liabilities into assets.

Keep reading to learn more, or apply for receivables financing with Commercial Finance Group today!

Challenges In Healthcare Receivables Management

While the changing of the Presidential guard may mean this is all about to change, it’s no secret that the healthcare industry changed dramatically with the implementation of the Affordable Care Act.

The ACA resulted in a massive expansion of the number of people who had insurance coverage for their medical needs, many of them doing so thanks to relaxation in eligibility requirements for Medicaid and Medicare. However, this meant that healthcare providers had to deal with an influx of both patients and third-party payers who expected a payment turnaround time of 45 days to 90 days, sometimes longer.

This puts extreme strain on the accounts receivable department, and stretches out cash flow levels to near breaking.

Problems With Turning To Collections

When a client is slow to pay their invoice, whether they’re an individual, an insurance company, or the government, healthcare businesses have an important decision to make. Will they attempt to collect the debt on their own or will they turn the process over to a professional collections agency? In most cases, both are undesirable options. On one hand, you’ll have to spend valuable hours of labor making phone calls and typing up collections letters, on the other, you’ll have to shell out a massive retention fee to have a collections agency do it for you. Even if the collection agency is successful, it will still take time for you to recover the cost of the invoice and you’ll likely have destroyed the relationship with that customer for life.

The good news is, these aren’t your only two options. When you choose receivables financing you have a third alternative that often turns out to be more profitable and amicable for all parties involved.

Healthcare Receivables Financing From Commercial Finance Group Can Help

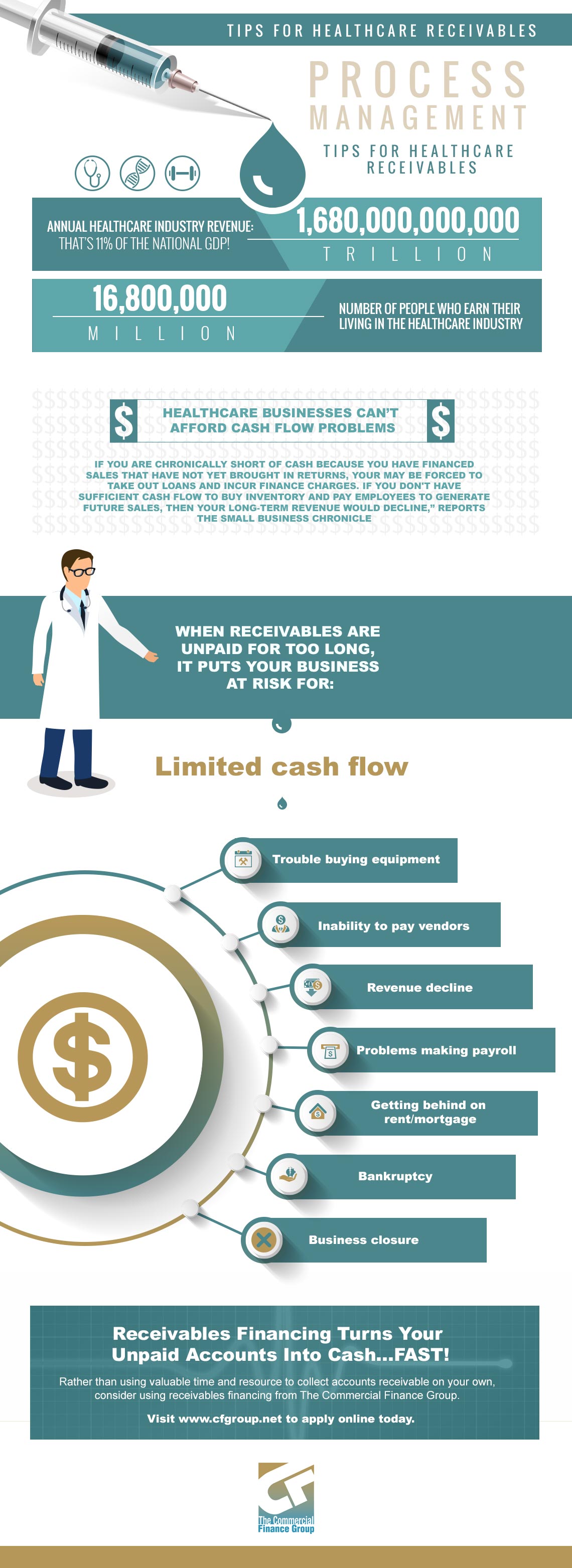

If you’ve realized that your company is slowly drowning in a sea of unpaid invoices, account receivables financing may be able to provide a short-term solution. Through this financial solution, we’ll purchase these debts at a slightly discounted rate, and completely take over the duty of collecting your accounts receivable. You get access to cash for services that have already been rendered, while relieving yourself and your staffers of the burden of collections. In most cases, it’s a win-win situation that breathes life back into struggling healthcare companies.

Want to learn more? Contact The Commercial Finance Group today.