To many, the holiday season, Independence Day, Memorial Day weekend, or even St. Patrick’s day might be their favorite time of year. Of course, everyone has a valid reason (or many valid reasons) to have a favorite time of year. While we might not share this with the majority of people, to no surprise, our favorite week of the year has finally arrived: National Small Business Week!

Celebrating National Small Business Week

As put on by the U.S. Small Business Administration, this is (to us, at least!) a special time of year where small business owners, patrons of small businesses, and other citizens come together to celebrate and learn more about the backbone of the United States economy. Since the 1950s — July 30th, 1953 to be exact — the U.S. Small Business Administration has provided millions of loans, loan guarantees, various contracts, counseling sessions, and other invaluable resources to well-established and aspiring small business owners alike to grow their ideas and, ultimately, achieve access in a rapidly growing and diversifying business market.

How Our Small Business Loan Providers In Los Angeles Play Our Part

You might be thinking, “Isn’t that similar to how you guys help grow small businesses at The Commercial Finance Group?” Well, yes, in a sense, you’d be correct! While our small business loan providers in Los Angeles and Atlanta may not review Congressional legislation and work alongside the United States government in the same way that the U.S. Small Business Administration does, we do help owners finance their dreams and help companies grow to expand their operations.

Custom Working Capital Solutions

The Commercial Finance Group primarily helps provide working capital for small businesses in the form of asset-based loans and factoring. Our unique and flexible approach to small business lending allows us to provide more custom-tailored financing solutions to your company, resulting in positive business developments including:

- Augmenting growth

- Accelerating equity value

- Providing rapid access to capital (significantly faster than traditional banks)

- And more to help your small business flourish!

If your company is experiencing any cash flow issues, The Commercial Finance Group can most likely alleviate those issues with our rapid and effective cash flow solutions. Learn more by getting in touch with our small business lenders in Los Angeles and Burbank!

Now, as we mentioned above in our title, we have some promised small business facts to cover in light of National Small Business Week! Let’s take a look.

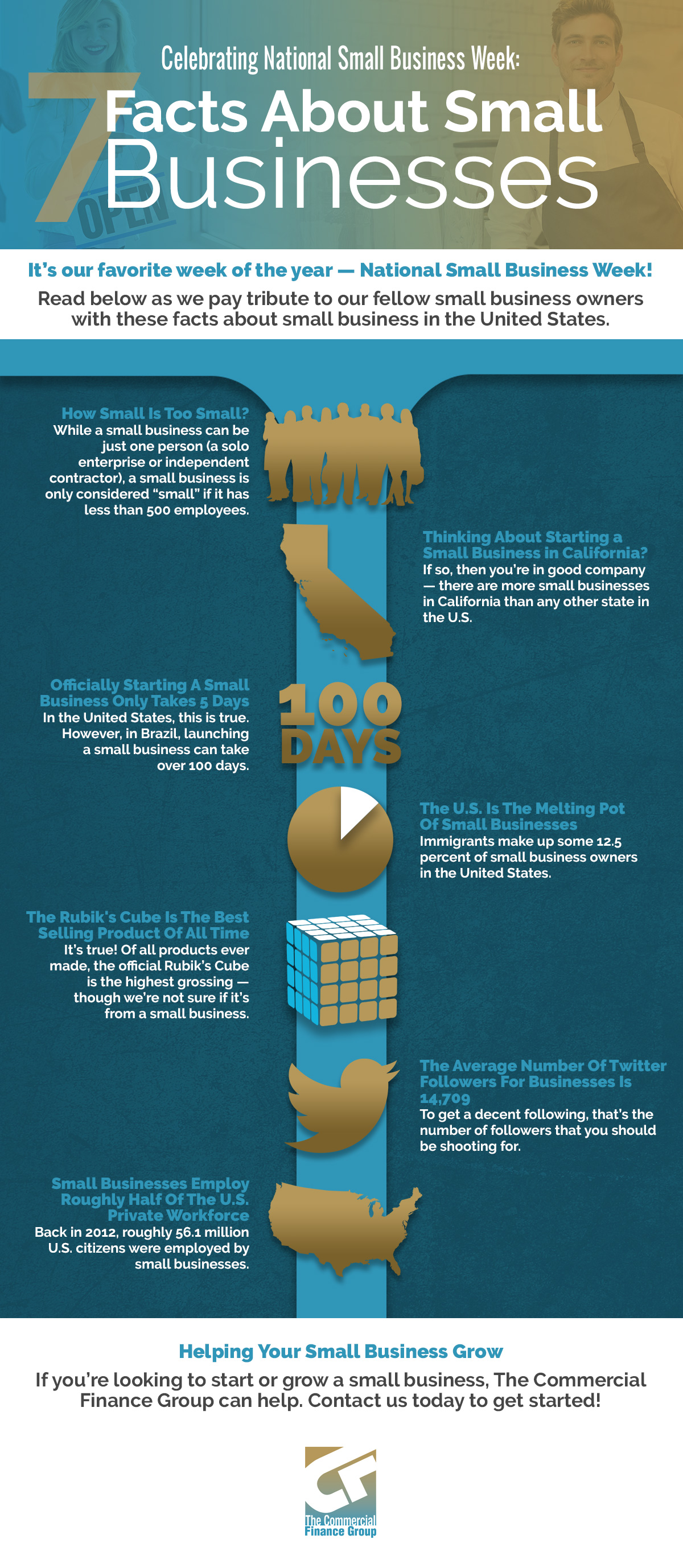

The Threshold For A Small Business

It would only make sense that an organization like the U.S. Small Business Administration sets the standard for small business sizing. How small is small, and at what point does a business become a “medium-sized” business? Well, according to the U.S. SBA, if you have less than 500 employees, then you’re officially a small business.

Small Businesses Can Be Solo Enterprises

Just because you own a small business, that doesn’t necessarily mean that you have any employees…other than yourself, of course! Loners, unite (we realize the irony in that statement, don’t worry) — of the 28 or so small businesses in the country, rough 22 million of those are “non-employers.” So, in other words, most small businesses are just solo enterprises.

The State With The Highest Number Of Small Businesses

If you’re looking to steer clear of competition, then we suggest against opening a small business in a particularly saturated industry…in California. Of course, our Los Angeles location is well aware of the fact that California boasts the highest number of small business in the United States. Now, you too are aware of this fact!

Think That Small Business Don’t Create Many Jobs? Think Again

Yes, above, we did mention that 22 million of the roughly 28 million small businesses in the United States are just one person working for themselves — an independent contractor, if you will. However, those 8 million small business that do employ people have a remarkable impact on the economy as well as employing the private workforce of America.

Indeed, some 56.1 million people — or roughly half of the country’s private workforce — was employed by a small business (in 2012). Perhaps larger corporations don’t exert as much influence over the privately-employed workforce than people thought.

whether or not it’s small business week. Are you ready? Get started by getting in touch with The Commercial Finance Group.

Launching A Small Business Can Be A Very Rapid Process In The U.S.

Of course, by “launching a small business,” we mean technically launching it. Naturally, it’s going to take months to years before you’re really off the ground growing a scalable company with actual employees and a healthy cash flow, but in reality, deciding on a name and officiating your small business doesn’t take very long. Well, in the United States, at least.

Conversely, over in Brazil, you’re looking at more of a 107 day start time just to say that you’ve “started” a small business.

Move To The United States, Start A Small Business

Why not? After our last point, there’s hardly any doubt that Brazil immigrants with some truly great ideas have moved to the promised land of opportunity to start up a new business venture. Indeed, immigrants from around the world are said to make up around 12.5 percent of small business owners around the country. This certainly contributes to our nation’s cultural melting pot, and it’s another reason to give thanks to the concept of small business.

The Single Best Selling Product Of All Time

We’re not exactly sure that you could say whoever makes these is what you would consider a “small” business. Can you guess as to what the highest grossing product of all time is? Hint: it’s not electronic or technology-related. Truly standing the test of time, it’s something that people from all generations can enjoy: The Rubik’s Cube!

Shooting For An Ideal Amount Of Twitter Followers

It’s no secret that social media and digital marketing are the key to online visibility and growing the presence of your business. If you’re looking to grow your number of Twitter followers and you’re wondering what the ideal benchmark is for the average business following, you should be shooting for somewhere around 14,709 followers. That’s more than a fair amount of visibility!

If You’re Not On Facebook, You Should Be

Though the number of users on Facebook has more or less stagnated over the years, it’s still the hottest social media platform for businesses of all sizes to be on. With 82 percent of small businesses registered on their site, that’s…well, the vast majority of small businesses out there, to be sure. Facebook is followed by Youtube at 73 percent, and Twitter and LinkedIn who both share 47 percent.

How Are You Celebrating Small Business Week?

Perhaps you’re going to eat at a local restaurant that you haven’t visited in awhile, or maybe you’re going to order something off of Etsy that supports a small artist. Whatever the case, celebrate Small Business Week by supporting small businesses!

Get Help For Your Own Small Business By Contacting The Commercial Finance Group

Through asset-based lending and finance factoring, our small business loan providers in Los Angeles and Atlanta are prepared to help you grow and succeed whether or not it’s small business week. Are you ready? Get started by getting in touch with The Commercial Finance Group.